Part time wage calculator

Determine the number of hours that part-time employees work. The minimum wage in 2017 was increased to 10 per hour resulting in a self.

Easy Fte Calculator See Employee Costs Revenue Clicktime

Labor department sets limit on use of tip credit for server side work October 28 2021.

. Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. A wage garnishment requires employers to withhold and transmit a portion of an employees wages until the balance on the order is paid in full or the order is released by us.

Or see your hourly weekly and monthly earnings. For most occupations its someone who works 2080 hours a year including paid vacations 40 hrswk times 52 weeks. Check National Minimum Wage and National Living Wage rates before March 2022.

Part-time and Intermittent Employees. Oklahoma Student Minimum Wage - 616 - Full-time high school or college students who work part-time may be paid 85 of the Oklahoma minimum wage as little as 616 per hour for up to 20 hours of work per week at certain employers such as work-study programs at universities. 330 335 time spent changing into specialized protective gear at work is an integral part of the job and is thus.

Search for a state city or metro area. Hourly weekly biweekly semi-monthly monthly quarterly and annually. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z.

First enter the dollar amount of the wage you wish to convert as well as the period of time that the wage represents. Tariff D is for part-time earners. For example if you did 10 extra hours each month at time-and-a-half you would enter 10 15.

Payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind. Earnings withholding orders for taxes EWOT. Big American companies increasing wages amid worker shortages October 24 2021.

Find out how much you make per year. This applies to companies that also have part-time employees. Fewer than 30 hours per week is considered part-time.

Report their hourly wage rates. 2010 598 F3d 1217 12281229 time spent changing into police uniform not compensable if officer has option of changing at home with Steiner v. 2017 Child Support Calculator.

The assumption is the sole provider is working full-time 2080 hours per year. However the annuity calculation for periods of part-time service after April 6 1986 is prorated to reflect the difference between full-time and part-time service. Amazon hourly staff for Christmas season will start at 18 October 21 2021.

In 2022 the lowest minimum wage is 1181 per. The average part-time weekly wage across the UK is 11220 a week but the top 15 of students take home more than 200. Use this free salary calculatorsalary converter to calculate your annual earnings.

The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living. This calculator can convert a stated wage into the following common periodic terms. Ontario hourly rate to annual salary calculator and converter.

Minimum Wage In The News. Section 15 Self-Support Reserve Test of the 2018 Child Support Guidelines states that the self-support reserve shall be an amount equal to 80 of the monthly full-time earnings at the current state minimum wage at the time of the order. The Calculator will show the total payroll cost at the end of Step 3.

What is a full-time employee. Salaried employees with non-standard work hours. Use the calculator and read our guide to find out everything you need to know.

247 256 76 SCt. Students in the east of England earn the most at 13170. Starbucks to raise minimum wage to 15 per hour October 27 2021.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. Report their hourly wage rate. This means that there are cheaper places of residence but also more expensive ones.

The increases are calibrated by industry and by region in order to provide businesses ample time to adjust. On December 31 2016 the first in a series of wage increases went into effect. Should we report the average wage rate for all employees in the.

Mississippi has one of the lowest living costs in the country but it also regularly ranks as one of the worst states to live in. With that said 40 hours is the standard amount worked on a full-time salary in Canada. Enter the number of hours you work a week and click on Convert Wage.

5 hours double. Personal Income Tax Earnings Withholding Order For Taxes FTB 2905. A regular employee is someone who works a maximum of 40 hours minimum 30 hours each week for more than 120 days each year.

The statewide 15 minimum wage was enacted as part of the 2016-17 State Budget. City of Mesa 9th Cir. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses. A prevailing rate employee who works on a regularly scheduled shift of less than 8 hours duration such as a part-time or intermittent employee is entitled to a night shift differential if a majority of the employees hours are worked during a period in which a night shift differential is payable. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Calculate the number of working hours of full-time employees per period. Living Wage Family of 4. The plan takes the needs of workers and businesses alike into account.

For the Wage calculator Switzerland the canton in which you live is quite important because - unlike in Germany - the withholding tax is determined by the place of residence. Consultants can also use this wage calculator to convert hourly rate into annual income. Mitchell 1956 350 US.

Living Wage Family of 4. Gross-net calculator Switzerland - how to pay. Steps 4 to 7 will allow you to enter all of the additional hidden costs of an employee.

We issue 3 types of wage garnishments. Living Wage Calculation for Arizona. The Florida bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Your employee must be at least 23 years old to get the National Living Wage. Employees who are considering a change to a part-time work schedule should obtain an estimate of their retirement benefits from their agencys benefits office.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hourly To Salary What Is My Annual Income

Salary Formula Calculate Salary Calculator Excel Template

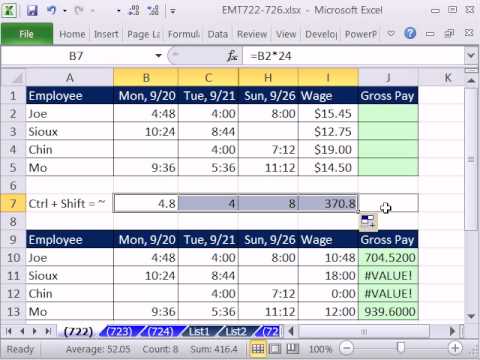

Overtime Calculator

Hourly To Salary Calculator

Salary Formula Calculate Salary Calculator Excel Template

Salary Calculator Convert Wage Into Hourly Monthly Annual Income

How To Calculate Wages 14 Steps With Pictures Wikihow

Hourly To Salary Calculator Convert Your Wages Indeed Com

How To Calculate Fte Salary Youtube

Overtime Calculator To Calculate Time And A Half Rate And More

Gross Pay Calculator Sale 58 Off Www Ingeniovirtual Com

3 Ways To Calculate Your Hourly Rate Wikihow

Salary Formula Calculate Salary Calculator Excel Template

Wages And Salary Calculator

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide